In this write-up, we will discuss Land Transfer Tax in Ontario and how it is calculated with an example. Land transfer tax is the biggest component in the closing costs when we purchase Real Estate and it is imperative for us to understand what it involves.

When a property exchanges hands in Ontario, Land Transfer Tax is paid to the government at the time to title registration or transfer of deed in the new buyer’s name. In this session, we will explore and try to make it clear to buyers how that calculation is done.

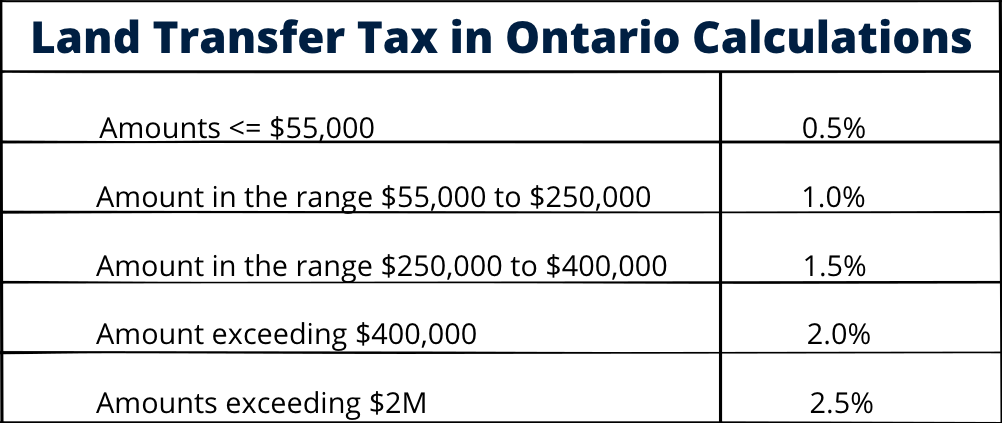

Here you can review the various rate slabs or tiers which are used in the calculation of Land Transfer Tax in Ontario:

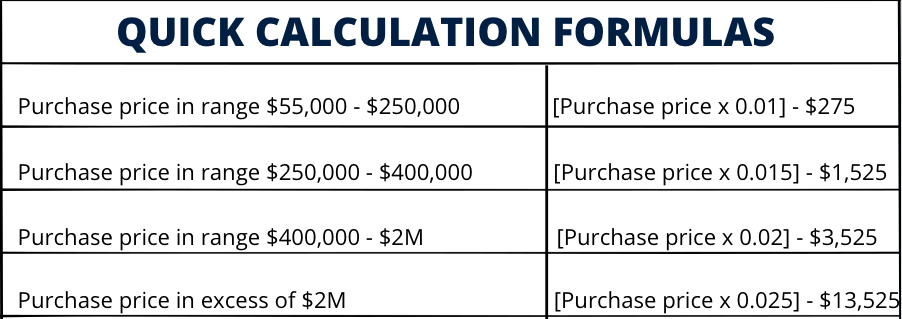

And here we can review some QUICK CALCULATION FORMULAS for arriving at LAND TRANSFER TAX

Let’s take a quick example, applying our formula for arriving at Land Transfer Tax, assuming we are purchasing a property for $578,000.

Land Transfer Tax = ($578,000 x 0.02) – $3,525

= $11,560 – $3,525

= $8,035

Now, that we are aware of the land transfer tax calculation, let’s consider some rebates which the Ontario government extends to first-time homebuyers. They are eligible for a maximum of $4,000 rebate in land transfer taxes at the time of purchase. This is an immediate refund and can be claimed at the time of property registration by your lawyer. Below are some conditions required to fulfill. The purchaser must be over 18 and occupy the home within 9 months of registration.

The purchaser must be over 18 and occupy the home within 9 months of registration. The purchaser or spouse cannot have owned a home anywhere in the world.

The purchaser or spouse cannot have owned a home anywhere in the world. The eligibility is also limited to Canadian Citizens and permanent residents of Canada.

The eligibility is also limited to Canadian Citizens and permanent residents of Canada.

In our above example, if the purchaser was a first-time home buyer, the LTT to be given at the time of registration would be $4,035.

If you are buying property in Toronto, it also attracts Toronto Municipal Land Transfer Ta. The municipality charges a land transfer tax for the town in addition to the provincial land transfer tax as we noted in our example. Essentially, for a property in Toronto, you would be paying just the double of land transfer tax you pay for property elsewhere in Ontario.

So, in our above example, if the same property were located in Toronto and we would have bought it at the same purchase price of $578,000, the land transfer tax would have been $16,070.

Municipal Land Transfer Tax (Toronto) also has a provision for the rebate to be availed by first-time home buyers up to a maximum of $4,475. Extending our example if the buyer for the Toronto property were first-time home buyers they would have received both provincial ($4,000) as well as municipal ($4,475) rebates.

The land transfer tax payable for Toronto property with a price of $578,000

= $16,070 – $4,475 – $4,000

= $7,595

Wish you all the very best! Reach out to our dedicated team at Elixir for any queries you have in Real Estate and we will do our best to help.

Mudit Mehta

Broker of Record

ELIXIR REAL ESTATE INC.

Off: 416-816-6001 | [email protected]