In this write-up, we will discuss the concept of leverage in Real Estate Investments and how Real Estate investments outshine other forms of investments.

What does Leverage mean in Real Estate Investments?

The two most important concepts which make Real Estate investments stand out are Leverage and Capital Gains Exemption.

Homeownership is often referred to as opening up a mandatory savings bank account; with every mortgage payment, your equity in the property increases. Furthermore, in the long run, the asset is an appreciating one that adds to the value proposition.

Aside from being an appreciating asset, a resting place which we call our home brings quality of life, stability, and joy to the family and a nest to grow memories.

The leverage here is meant that with a small amount of money at 5%-20% as the down payment, you can buy a home worth much higher by leveraging the lending institution's money i.e. using the borrowing capital and utilizing its growth for your gains. When you sell the property down the years, the value appreciation in the home is for the entire property value and is yours to keep and not just the growth of your portion of the initial investment (down payment). This is a classic concept of Leverage.

Example:

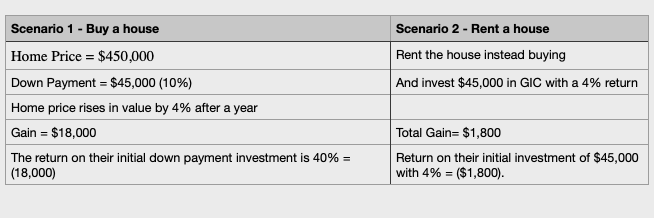

Let’s consider an example to understand better, suppose Joe and Jill buy a home for $450,000 by putting $45,000 (10%) as a down payment, and it rises in value by 4% after a year, so it's a gain of $18,000. The return on their initial down payment investment is 40% (18,000/45,000 * 100); if you reduce the other costs involved in closing costs/interest payments, the growth still outweighs the expenses. Further, we should add to this growth the principal component paid off with every mortgage payment, increasing their home equity.

On the other hand, if Joe and Jill had continued to stay in rental and instead bought a bond or a GIC with a 4% return on their initial investment of $45,000. It would have given them a return of $1,800. And no addition to their equity as part of paying rent.

To bring the point home let us extend this scenario to five years of duration and here you can see a side-by-side comparison of ROI in five years in both investment vehicles, GIC at 4% vs a Real Estate asset considering 4% annual growth. Here we can see how the leverage concepts help us realize a marked difference in ROI of more than $85,000. We should also note here that we didn’t yet add to this the equity which will be developing in this asset in five years as part of principal repayment in these five years. Of course, one would be paying the property tax and the maintenance of the property, but still, the difference is so huge that it outweighs the expense column.

The second incentive of home ownership is the Capital Gains Exemption. Any increase in the value of your home or any other investment vehicle is termed a capital gain. Any gains in mutual funds, stocks, bonds, or GICs, get added to your annual income, and you pay taxes based on your tax bracket.

However, capital gains realized are exempted for tax purposes for a primary residence in Canada. This makes homeownership much more appealing for first-time home buyers. This 100% tax exemption benefit is applicable only when you sell your primary residence; this is not true for secondary property, where 50% of the capital gain will become taxable.

There are cases when you are better off staying on rent, and you can visit my blog  Renting Vs Buying, where I have tried to objectively compare rent vs buying for their advantages and disadvantages.

Renting Vs Buying, where I have tried to objectively compare rent vs buying for their advantages and disadvantages.

Wish you all the very best! Reach out to our dedicated team at Elixir for any queries you have in Real Estate and we will do our best to help.

Mudit Mehta

Broker of Record

ELIXIR REAL ESTATE INC.

Off: 416-816-6001 | [email protected]

.png)